accumulated earnings tax reasonable business needs

Given the reasonable needs of the. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today.

Improperly Accumulated Earnings Mpcamaso Associates

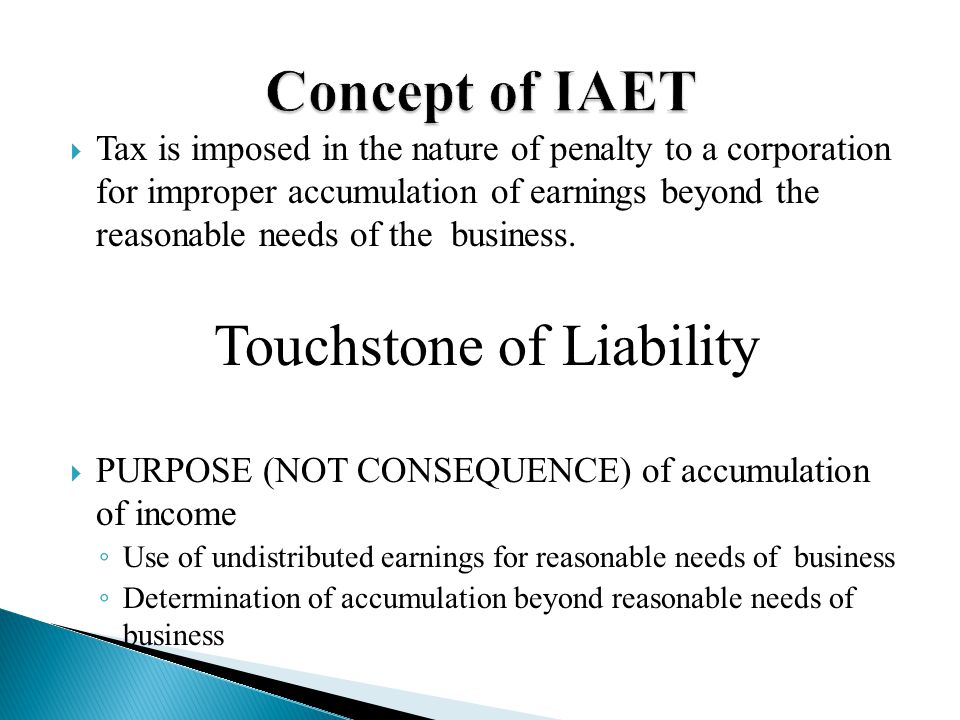

The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income.

. 250000 for nonservice corporations only The accumulated earnings tax which is imposed on corporations for the. This is a federal tax levied on businesses that are considered invalid and have above-average incomes. And profits have been allowed to accumulate beyond the reasonable.

Needs of the business. This tax was created to discourage companies from. Tax on Accumulated Earnings.

Specific definite and feasible plans of usage for the accumulated earnings. 2 redemptions in connection with sec-. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax.

Marjorie corporations total reasonable business needs for 2021 was 320000. Strategies for Avoiding the Accumulated Earnings Tax. Accounting questions and answers.

The PHC tax is self-imposed. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the. When the PHC tax applies there is relief from the accumulated earnings tax Section 532a b1.

The Tax Code defines reasonable needs to include the reasonably anticipated needs of the business. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. In any proceeding before the Tax Court involving the allegation that a corporation has permitted its earnings and profits to accumulate beyond reasonable business needs the.

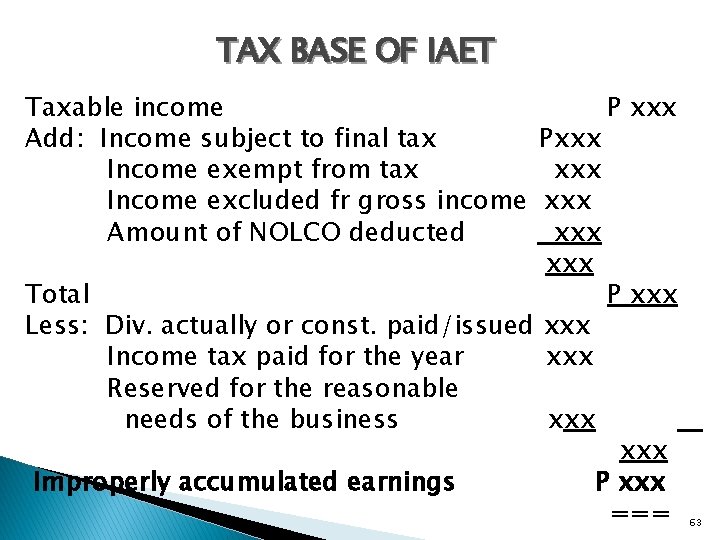

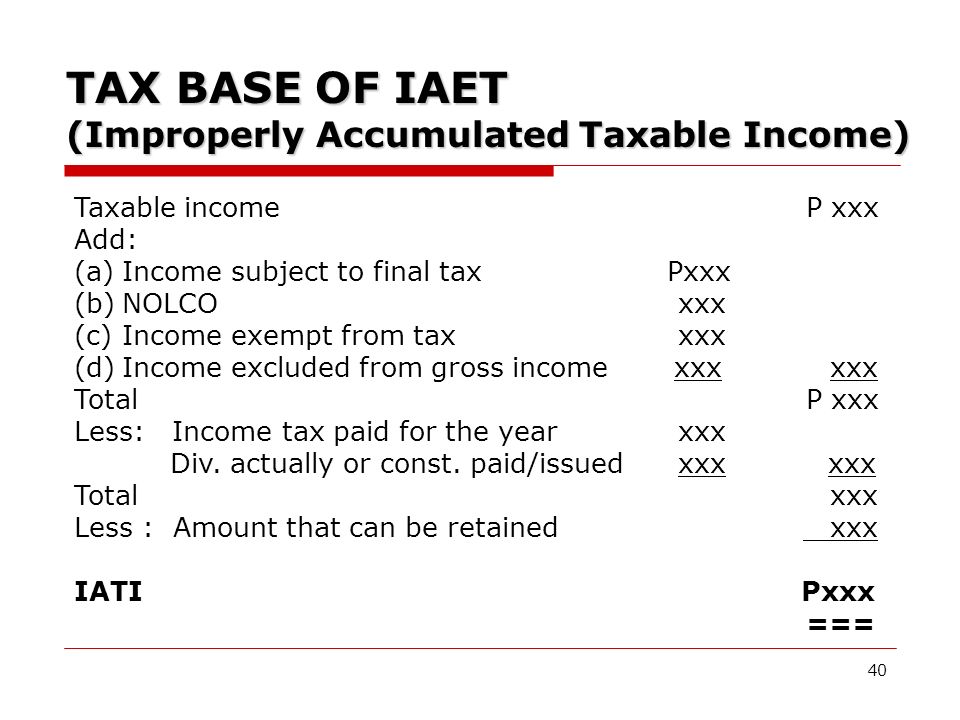

The need to retain earnings and profits. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. 1537-2a Income Tax Regs.

If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the. Tion of earnings beyond the. The AET is a penalty tax imposed.

Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. When applicable the accumulated earnings tax is.

1 Accumulated taxable income is. Within the reasonable needs of the business rubric. Business needs before the accumulated earnings tax is imposed.

Tion 303 relating to payment of a deceased. Or The amount of current year. An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that.

The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. 250000 or 150000 for personal service corporations less the amount of accumulated earnings and profits at the end of last tax year.

Anticipated needs of the business. 2 days agoThe accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. The IRS defines some of the criteria that meet the reasonable needs condition.

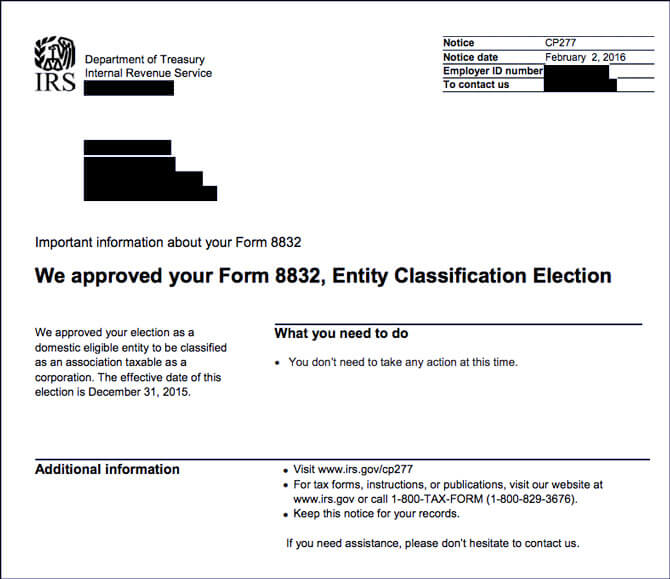

Llc Taxed As C Corp Form 8832 Pros And Cons Llc University

Income Tax Computation For Corporate Taxpayers Prepared By

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines

Solved Pera Pera College An Educational Institution Provided The Following Data For The Current Year Income From Tuition Fees P3 000 000 School Course Hero

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Ppt Income Tax Computation Powerpoint Presentation Free Download Id 5193687

Solved Pera Pera College An Educational Institution Provided The Following Data For The Current Year Income From Tuition Fees P3 000 000 School Course Hero

Doing Business In The United States Federal Tax Issues Pwc

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

:max_bytes(150000):strip_icc()/GettyImages-1128492098-f6606fdc398b4e0bbecbe4c2fe8493eb.jpg)

Accumulated Earnings Tax Definition

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc Tax And Accounting Center Inc

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download